Arkansas Cannabis Market Analysis: Medical Success, Adult-Use Potential, and the Bible Belt Challenge

How the Natural State could optimize its medical program and prepare for adult-use legalization

The Silent Majority 420 | November 2025

This analysis uses the Consumer-Driven Black Market Displacement (CBDT) Framework, validated across 24 U.S. cannabis markets with 5% mean absolute error. View validation data on Harvard Dataverse.

Arkansas's Cannabis Paradox

Arkansas presents a fascinating cannabis policy paradox: a deeply conservative Bible Belt state with a functioning medical marijuana program that serves 112,000+ patients, yet one where the Governor actively opposes any expansion and where voters narrowly rejected adult-use legalization in 2022 (44%-56%).

The state's medical program, established by constitutional amendment in 2016, generates substantial tax revenue and serves a significant patient population. Yet Arkansas also maintains some of the harshest penalties for illegal possession in the nation—including mandatory six-month driver's license suspension for any cannabis conviction.

Current medical market: ~$300-400 million annually, 38 dispensaries serving 112,760 patients Potential adult-use market: ~$650-850 million annually (if legalized and optimized) Current legal share (medical-only): Estimated 25-35% of total cannabis consumption Potential adult-use legal share: 75-82% (with proper policy framework)

The question: Can Arkansas apply lessons from successful adult-use states while respecting conservative values—and what would it take to win voter approval in the Bible Belt?

Arkansas's Current Medical Program: Strengths and Limitations

What Works Well

Constitutional protection: Medical cannabis is enshrined in the state constitution (Amendment 98), making it harder for hostile political actors to eliminate. This differs from states where medical programs exist by statute alone.

Strong patient participation: With 112,760 active patients out of ~3 million residents, Arkansas has one of the highest per-capita medical enrollment rates in the nation (3.75% of population). Compare to more permissive states where medical enrollment is lower due to easy recreational access.

Geographic distribution: The state's 8-zone dispensary licensing system ensures some level of coverage across rural and urban areas, though density remains low. Each zone has 4-5 dispensaries serving specific regions.

Tax revenue generation: Medical cannabis taxes fund state programs including school breakfast initiatives (SB59, 2025), demonstrating tangible community benefit.

Testing and safety standards: Arkansas requires comprehensive testing for pesticides, potency, microbials, and heavy metals—ensuring product quality comparable to established markets.

Critical Limitations

Artificially low dispensary density: Arkansas caps licenses at 40 dispensaries for 3 million residents (1.3 per 100,000 population). Compare to:

- Oregon: 16.8 per 100k

- Colorado: 14.2 per 100k

- Oklahoma: 26+ per 100k (medical-only)

This artificial scarcity forces patients to travel long distances, particularly in rural mountain regions, making illicit market access more convenient.

No home cultivation: Unlike Oklahoma's medical program (which allows home grow), Arkansas patients must purchase from dispensaries. This eliminates a significant legal supply option for rural patients and those seeking cost savings.

Restricted delivery: Current regulations limit delivery options significantly. Governor Sanders vetoed HB1889 (2025), which would have expanded delivery access and authorized drive-through dispensaries.

Banking barriers: Like all states, Arkansas dispensaries face federal banking restrictions (no SAFE Banking Act), forcing cash-heavy operations that increase security risks and reduce consumer convenience.

280E burden: Medical businesses cannot deduct normal operating expenses, inflating prices 15-20% beyond what competitive market economics would dictate.

High illicit market penalties: Possession under 4 ounces without a medical card carries up to $2,500 fine, one year imprisonment, and mandatory six-month license suspension. These harsh penalties don't reduce illicit market participation—they just criminalize consumers.

The 2022 Adult-Use Initiative: What Happened and What It Teaches

Issue 4: The Failed Legalization Effort

In November 2022, Arkansas voters rejected Issue 4 (adult-use legalization) by a 44%-56% margin. The initiative would have:

- Legalized possession of up to 1 ounce for adults 21+

- Expanded existing dispensaries to adult-use sales

- Imposed 10% excise tax (in addition to sales tax)

- Directed revenue to law enforcement (15%), UAMS (10%), drug courts (5%), and general fund (70%)

Why It Failed

Insufficient conservative messaging: The campaign focused on tax revenue and criminal justice reform but didn't adequately address conservative concerns about public safety, impaired driving, and youth access.

Law enforcement opposition: Despite 15% of revenue going to police departments, many local law enforcement groups campaigned against the measure. Conservative voters trust police messaging on public safety issues.

Governor's active opposition: Governor Sarah Huckabee Sanders campaigned against the initiative, using her platform to amplify opposition messaging.

Medical industry opposition: Ironically, some existing medical cannabis businesses opposed adult-use, fearing increased competition and regulatory burdens.

Incomplete rural outreach: The campaign didn't sufficiently address how legalization would benefit rural Arkansas economically—missing an opportunity to build coalition with agricultural communities.

Federal prohibition framing: Opponents successfully framed legalization as defying federal law, which resonates negatively in conservative Arkansas.

What 56% "No" Tells Us

The 44% "yes" vote is actually substantial for a first-attempt adult-use initiative in a conservative state. Compare to:

- North Dakota: 36% (2018), 45% (2022)

- South Dakota: 51% yes (2020, later overturned), 47% no (2022 re-vote)

Arkansas voters aren't universally opposed to legalization—they just weren't convinced by this specific proposal's framing and safeguards.

Path forward: A better-designed initiative with conservative-friendly messaging, robust impaired driving provisions, and explicit federal reform triggers could win 52-55% approval.

The Bible Belt Challenge: How to Win Conservative Support

Learning from Successful Conservative State Campaigns

Montana (2020): Adult-use passed 57%-43% in a conservative state by emphasizing:

- Tax revenue for habitat conservation (appeals to hunters/outdoorsmen)

- Strict impaired driving penalties (addresses public safety)

- Local control (allows counties to opt-out)

- DUI reform paired with legalization (shows responsibility)

Missouri (2022): Passed 53%-47% in a purple-leaning-red state through:

- Expungement provisions (criminal justice reform messaging)

- Revenue to veterans' services (conservative-friendly spending)

- Home cultivation allowed (libertarian appeal)

Arkansas-Specific Conservative Messaging

1. Property rights and agricultural opportunity

Frame cannabis cultivation as an agricultural economic development opportunity for rural Arkansas. The state's economy depends heavily on farming (rice, soybeans, poultry). Cannabis represents a high-value crop option for struggling farms.

Messaging: "Arkansas farmers should decide what to grow on their own land. Cannabis cultivation creates 500-800 high-paying jobs in rural communities and generates $15-20M in agricultural revenue."

2. Criminal justice reform through a law-and-order lens

Arkansas spends ~$15-20 million annually enforcing marijuana prohibition. These resources could redirect to violent crime, property crime, and methamphetamine enforcement.

Messaging: "Let's stop wasting police resources on marijuana and focus on real crime. Legalization frees up 15,000+ police hours annually for meth enforcement and violent crime investigation."

3. States' rights and federal overreach

Frame legalization as Arkansas deciding its own policy rather than following federal mandates. Conservative Arkansans respond to states' rights messaging.

Messaging: "Washington shouldn't tell Arkansas how to regulate a plant that grows in our soil. 24 states have legalized—time for Arkansas to control our own destiny."

4. Tax revenue for conservative priorities

Direct revenue toward genuinely conservative causes:

- Veterans services (25% of revenue)

- Rural law enforcement funding (20%)

- Addiction treatment (15%)

- General fund / tax reduction (40%)

Avoid progressive spending priorities that alienate conservative voters.

5. Strict impaired driving provisions

Address public safety concerns head-on with toughest-in-nation DUI penalties:

- Zero-tolerance for drivers under 21

- Enhanced penalties for impaired driving with child in vehicle

- Mandatory drug recognition expert training for all state police

- $5M annual funding for DUI enforcement from cannabis taxes

Messaging: "Legalizing doesn't mean tolerating. Arkansas will have the strictest impaired driving laws in America."

6. Family-focused regulation

Emphasize child-protection measures:

- No dispensaries within 1,000 feet of schools (vs. 500 feet in some states)

- Plain packaging requirements (no cartoon characters or bright colors)

- Mandatory ID scanning (prevent underage access)

- Parent notification if minor attempts purchase (like alcohol)

Messaging: "Legalization with the strongest child-protection standards in America."

Medical Program Optimization: What Arkansas Can Do Now

Even without adult-use legalization, Arkansas can significantly optimize its medical program to better serve patients and reduce illicit market participation.

Immediate Reforms (Within Current Authority)

1. Expand delivery access

The legislature should override Governor Sanders' veto and pass expanded delivery authorization. Rural patients in the Ozark and Ouachita Mountains face 60-90 minute drives to nearest dispensaries.

Impact: Improves rural patient access, reduces illicit market convenience advantage. Studies from other states show delivery authorization increases legal market participation by 3-5 percentage points.

2. Authorize drive-through dispensaries

Drive-through service improves convenience, particularly for elderly and disabled patients. This was included in vetoed HB1889.

Impact: Reduces transaction time, improves accessibility, competitive with illicit market convenience.

3. Add qualifying conditions

Arkansas's qualifying condition list is more restrictive than many medical states. Consider adding:

- Opioid use disorder (substitution therapy)

- Anxiety disorders

- Insomnia

- Migraines

- Inflammatory bowel disease

Impact: Expands patient base, provides harm reduction alternative to opioids, increases legal market share.

4. Reduce licensing barriers for cultivators

Arkansas caps cultivation licenses at 8—artificially constraining supply and inflating prices. Increasing to 12-15 cultivators would:

- Increase competition (lowers prices)

- Improve product variety

- Reduce shortage risk

- Generate additional licensing revenue

Impact: Price reduction of 10-15% improves price competitiveness with illicit market.

Longer-Term Optimization (Requires Legislative Action)

1. Home cultivation for medical patients

Oklahoma's medical program demonstrates that home grow doesn't cannibalize dispensary sales—it complements them. Allow patients to grow 6 plants for personal use.

Rationale: Home cultivation is substantially more expensive than dispensary purchases for most consumers (equipment, time, expertise). Patients who grow typically still purchase specialty products from dispensaries. Home grow primarily benefits rural patients with access challenges.

Impact: Improves rural access, reduces illicit market participation by offering legal alternative, minimal revenue impact.

2. Expand dispensary licensing

Increase cap from 40 to 60-80 dispensaries phased over 3-5 years. Priority for:

- Rural underserved counties

- Social equity applicants

- Delivery-only operations (lower overhead, serves rural areas efficiently)

Impact: Improves geographic coverage, increases competition, reduces prices.

3. Reduce excise tax

Arkansas currently imposes standard sales tax on medical cannabis (no separate excise tax—this is actually good). If adult-use passes, keep combined burden under 20% total.

Rationale: Every 5% tax increase reduces legal market share by 2-3 percentage points. States with 25%+ taxes (California, Washington initially) struggle with illicit market competition.

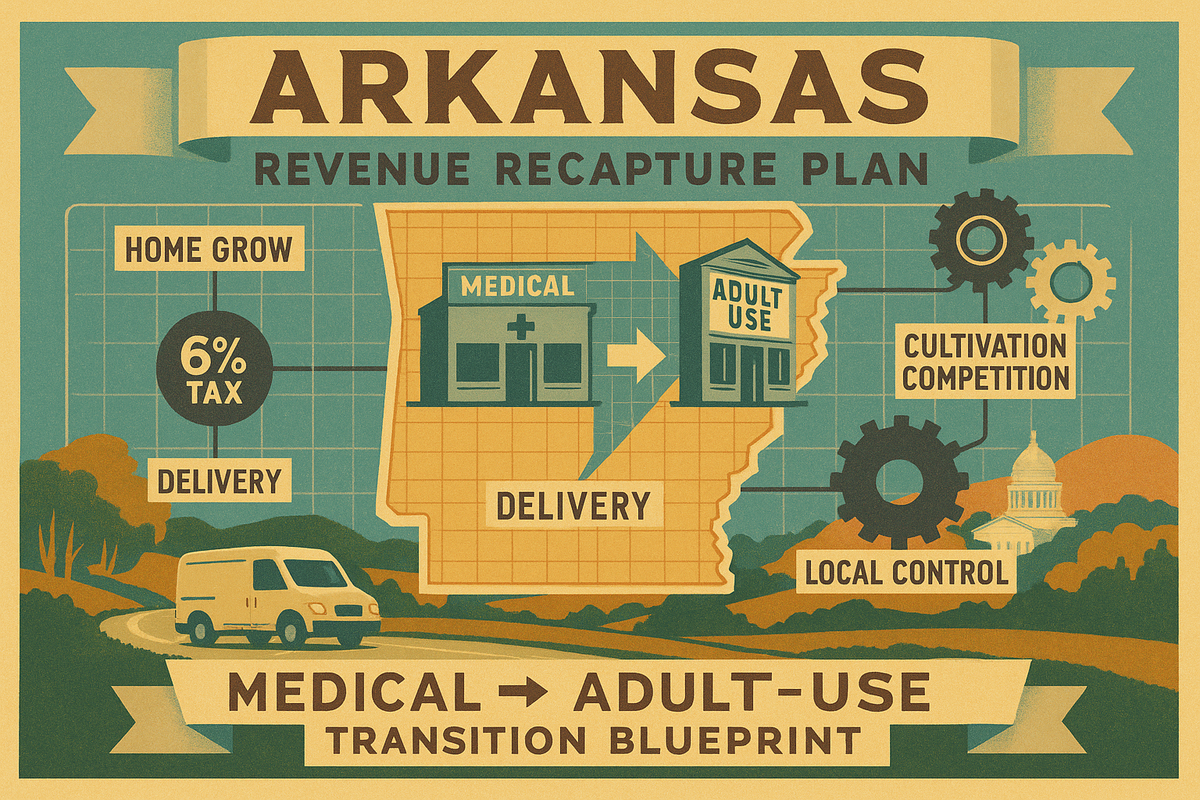

Projected Adult-Use Market Performance (If Legalized)

The CBDT Framework projects Arkansas's potential adult-use market performance under various policy scenarios.

Baseline Scenario: Moderate Policy (65-72% Legal Share)

Policy assumptions:

- 40-50 adult-use dispensaries (expanding from current medical infrastructure)

- 15-18% total tax burden (reasonable for competitive pricing)

- No home cultivation (conservative to pass initiative)

- Federal 280E burden continues (no SAFE Banking)

- Moderate delivery restrictions

Projected outcomes:

- Legal market size: $650-750 million annually

- Legal market share: 65-72% of total consumption

- State tax revenue: $100-135 million annually

- Employment: 4,000-5,500 direct jobs

Why not higher? Conservative policy restrictions (no home grow, limited delivery, moderate density) create persistent illicit market niches. Illicit market retains 28-35% share serving price-sensitive consumers, bulk buyers, and rural areas with limited access.

Optimized Scenario: Best-Practice Policy (75-82% Legal Share)

Policy assumptions:

- 60-80 adult-use dispensaries (higher density, rural coverage)

- 12-15% total tax burden (competitive pricing)

- Home cultivation allowed (6 plants, adults 21+)

- Federal reforms passed (Schedule III eliminates 280E, SAFE Banking enables cards)

- Delivery-only licenses authorized

Projected outcomes:

- Legal market size: $800-900 million annually

- Legal market share: 75-82% of total consumption

- State tax revenue: $96-135 million annually (lower rate × higher volume = similar revenue)

- Employment: 5,500-7,000 direct jobs

Why higher? Competitive pricing (from eliminated 280E + lower taxes), home grow option for rural patients, improved delivery access, and convenience factors (card payments) substantially reduce illicit market advantages.

Comparison to Similar States

Oklahoma (medical-only, permissive):

- High dispensary density (26+ per 100k)

- Home grow allowed

- Estimated 60-70% legal share (medical only)

Missouri (adult-use, conservative):

- Passed in 2022, implementing 2023

- Moderate restrictions, home grow allowed

- Early data suggests 65-75% legal share

Arkansas potential sits between these: More restrictive than Oklahoma (no home grow initially), but adult-use access broader than medical-only. Comparable to Missouri if policies align.

Federal Reform Impacts: Why Arkansas Should Care

The 280E Problem

Arkansas medical cannabis businesses currently operate under federal tax code Section 280E, which prohibits normal business deductions (payroll, rent, utilities, marketing). This creates effective federal tax rate of 40-70%, forcing retail prices 15-20% higher than competitive economics would dictate.

Impact on Arkansas:

- Medical: Prices currently $40-50 per eighth (3.5g) = $11-14/g

- Without 280E: Prices could drop to $35-40 per eighth = $10-11/g

- Illicit market: Estimated $8-10/g

Price gap: Legal cannabis currently 20-40% more expensive than illicit. Eliminating 280E closes gap to 10-20%, dramatically improving competitiveness.

The SAFE Banking Problem

Cash-heavy operations create:

- Security risks (dispensaries are robbery targets)

- Consumer inconvenience (ATM fees, cash-only)

- Tax compliance challenges (hard to track cash accurately)

- Banking access barriers (businesses can't get loans, insurance)

If SAFE Banking passes:

- Card payments reduce friction

- Normal banking enables business growth

- Insurance costs decline (improves economics)

- Security costs decline (less cash handling)

Impact: Convenience improvement worth 3-5 percentage points in legal market share.

Federal Rescheduling Timeline

The Biden administration initiated Schedule III rescheduling process in 2023. If completed:

- 280E automatically eliminated (cannabis no longer Schedule I/II)

- Banking restrictions partially eased (but SAFE Banking still needed for full resolution)

- State programs can operate without federal conflict

Arkansas-specific benefit: Federal reform makes conservative messaging easier ("Now that federal policy changed, Arkansas should update our approach too"). Removes "defying federal law" objection that hurt 2022 initiative.

The Rural Access Challenge: Why Geography Matters

Arkansas's Geographic Reality

Arkansas is 53,179 square miles with population of ~3 million. 43% rural (1.3 million residents).

Population centers:

- Little Rock metro: ~750,000 (central Arkansas)

- Northwest Arkansas (Fayetteville-Springdale-Rogers): ~550,000

- Fort Smith metro: ~280,000 (western border)

- Jonesboro metro: ~135,000 (northeast)

Mountain regions:

- Ozark Mountains (north): Rugged terrain, small towns, long distances between services

- Ouachita Mountains (west): Similar challenges, plus proximity to Oklahoma border

The problem: 38 dispensaries for 3 million people = 1.3 per 100k. Rural residents face 60-120 minute drives to nearest dispensary. Illicit dealers operate locally with 10-15 minute access.

Rural illicit market advantage:

- Convenience: Local dealer vs. 2-hour round trip

- Price: $8-10/g illicit vs. $11-14/g legal + gas costs

- Credit: Dealers often extend credit to known customers

- Anonymity: Rural communities value privacy

Solutions for Rural Access

1. Delivery-only licenses

Create low-cost license category ($5,000 vs. $25,000 for dispensary) specifically for delivery services. These operations can:

- Serve 100-mile radius from central location

- Schedule routes 2-3 days weekly per region

- Combine orders to make economics work

- Accept card payments (once SAFE Banking passes)

Model: Similar to beer distributors serving rural Oklahoma/Missouri. Proven business model.

2. Mobile dispensaries

Allow licensed dispensaries to operate mobile units (RVs or trailers) visiting rural towns on scheduled routes. Think "food truck" model but for cannabis.

Precedent: Some Native American tribes in other states use mobile units to serve reservation communities.

3. Cross-state reciprocity

Arkansas borders Oklahoma (medical, very permissive), Missouri (adult-use), and Tennessee (illegal). Allow Arkansas medical patients to purchase in Oklahoma/Missouri and bring back legally.

Benefit: Rural northwest Arkansas residents are often closer to Oklahoma dispensaries than Arkansas ones. Reciprocity acknowledges geographic reality.

Revenue impact: Minimal—these patients likely already purchase out-of-state illicitly or don't participate due to access barriers.

The Conservative Pathway: 2026 Initiative Strategy

Building the Coalition

Core supporters (need to maximize turnout):

- Existing medical patients and families (112,000+ households)

- Criminal justice reform advocates

- Libertarians (Arkansas has strong libertarian streak)

- Young voters (18-35)

Persuadable voters (need to win majority):

- Rural agricultural communities (economic development angle)

- Fiscal conservatives (tax revenue, reduced enforcement costs)

- Veterans (medical access, PTSD treatment)

- Law enforcement (redirect resources to violent crime)

- Small business advocates (entrepreneurship opportunity)

Opposition (likely unpersuadable):

- Social conservatives focused on morality

- Governor Sanders and administration

- Some law enforcement leadership

- Addiction treatment providers (fear of harm)

Target: Win 52-55% by expanding persuadable coalition, not by trying to convert opposition.

Initiative Design: Version 2.0

Key improvements over 2022 Issue 4:

1. Federal reform trigger clause

"If federal cannabis laws change to Schedule III or lower, Arkansas regulations automatically align with federal framework."

Benefit: Removes "defying federal law" objection. Shows initiative is forward-thinking, not radical.

2. Enhanced public safety provisions

- Toughest DUI penalties in nation

- Zero tolerance for drivers under 21

- $5M annual DUI enforcement funding

- Mandatory drug recognition expert training

3. Veterans' services funding

Direct 25% of cannabis tax revenue to:

- VA hospital expansion

- PTSD treatment programs

- Veterans' housing assistance

Messaging: "Support our veterans while reducing federal overreach."

4. Rural economic development

- Priority licensing for rural cultivators

- Agricultural tax credits for cannabis farmers

- Microbusiness licenses (small-scale cultivation/processing)

Messaging: "Keep family farms viable with high-value crop option."

5. Local control provisions

Allow counties to opt-out by local referendum (like alcohol in dry counties).

Benefit: Respects community standards, reduces opposition from deeply conservative areas.

Campaign Messaging Framework

Primary message: "Protect Arkansas values while ending a failed prohibition."

Supporting messages:

- Freedom: "Arkansas decides, not Washington bureaucrats"

- Safety: "Strictest impaired driving laws in America"

- Veterans: "25% of revenue supports those who served"

- Economy: "500-800 rural jobs, $15-20M agricultural revenue"

- Justice: "Stop wasting police time on marijuana, focus on violent crime"

Avoid:

- Social justice framing (doesn't resonate with conservative voters)

- National progressive movement associations

- Comparisons to blue states like California or Colorado

- Attacks on law enforcement

Timeline and Strategy

2025 (Preparation):

- Collect 90,000 signatures (requirement: 89,000 valid signatures)

- Build coalition with agricultural groups, veterans orgs, business associations

- Commission polling to test messaging

- Engage rural media (radio, local newspapers)

Early 2026 (Qualification):

- Submit signatures by July deadline for November ballot

- Prepare for legal challenges (expect Governor to oppose)

- Build war chest ($3-5M minimum for competitive campaign)

Mid-2026 (Campaign):

- Rural listening tours (emphasize local economic benefits)

- Veterans' endorsements (active duty, retired military, VFW)

- Law enforcement testimonials (retired officers supporting reform)

- Agricultural community outreach (Farm Bureau engagement)

October 2026 (Final Push):

- TV advertising emphasizing veterans, agriculture, freedom

- GOTV operation targeting medical patients, young voters

- Conservative validator ads (business leaders, rural voices)

November 2026:

- Win 52-55% (target: outperform 2022 by 8-11 points)

Economic Projections: What Legalization Means for Arkansas

Direct Economic Impacts

Legal market revenue: $650-900 million annually (depending on optimization)

State tax revenue: $80-135 million annually

- @ 12% rate × $650M = $78M (conservative scenario)

- @ 15% rate × $900M = $135M (optimized scenario)

Employment:

- Cultivation: 800-1,200 jobs

- Dispensary retail: 2,000-3,500 jobs

- Testing/compliance: 200-400 jobs

- Ancillary services: 1,000-1,900 jobs

- Total: 4,000-7,000 direct jobs

Multiplier effect: Cannabis employment generates 1.5-2× indirect jobs in local economies (construction, professional services, retail spillover).

Total economic impact: $800M-1.2B including multiplier effects.

Tax Revenue Allocation (Proposed)

Based on conservative-friendly priorities:

- Veterans' services: 25% ($20-34M annually)

- VA hospital funding

- PTSD treatment programs

- Veterans' housing assistance

- Rural law enforcement: 20% ($16-27M annually)

- Sheriff department funding

- Rural drug interdiction (meth, fentanyl)

- Equipment and training

- Addiction treatment: 15% ($12-20M annually)

- Opioid treatment expansion

- Mental health services

- Drug court programs

- General fund/tax relief: 40% ($32-54M annually)

- Property tax reduction

- Education funding

- Infrastructure

Comparison to Prohibition Costs

Current enforcement costs: $15-20 million annually

- Police time

- Court costs

- Incarceration

- Probation/supervision

Lost tax revenue from illicit market: $60-90 million annually

- At 15% tax rate × $400-600M illicit market

Total prohibition cost: $75-110 million annually

Net benefit of legalization: $155-245 million annually (tax revenue + avoided enforcement costs)

Addressing Objections: Evidence-Based Responses

Objection 1: "Legalization increases youth use"

Evidence: National data from states that legalized shows no statistically significant increase in youth use. In some cases, youth use declined post-legalization.

- Colorado: Youth use down 8% (2012-2019) post-legalization

- Washington: Youth use stable (no significant increase)

- Oregon: Youth use declined slightly

Why: Regulated dispensaries check ID rigorously (financial incentive: lose license if caught). Dealers don't check ID. Legal market actually makes access harder for minors by eliminating dealer convenience.

Arkansas-specific response: "Legalization with strict ID verification protects kids better than current system where dealers don't check ID."

Objection 2: "Legalization increases impaired driving"

Evidence: Fatal crash data shows mixed results:

- Colorado: Slight increase in THC-positive drivers, BUT correlation ≠ causation (THC detectable for weeks, doesn't prove impairment at time of crash)

- Washington: No statistically significant increase in impaired driving accidents

- National Highway Traffic Safety Administration: Insufficient evidence to conclude legalization increases impaired driving meaningfully

Arkansas-specific response: "We'll have the strictest DUI laws in America. Zero tolerance for impaired driving, $5M annually for enforcement, mandatory drug recognition expert training for all state police."

Objection 3: "Federal law still prohibits cannabis"

Evidence: 24 states have legalized despite federal prohibition. Federal government hasn't intervened in any state-legal program. DOJ policy is non-interference if states regulate responsibly.

Arkansas-specific response: "24 states made this decision. Time for Arkansas to control our own policy. Plus, our initiative includes trigger clause—if federal law changes, we automatically align."

Objection 4: "Tax revenue will be wasted"

Evidence: Colorado has generated $2+ billion in cannabis tax revenue since 2014, funding schools, infrastructure, and regulatory oversight. Transparent budgeting shows revenue used responsibly.

Arkansas-specific response: "Our initiative dedicates 25% to veterans, 20% to rural law enforcement, 15% to addiction treatment. Every dollar accounted for. No wasteful spending."

Objection 5: "It's a gateway drug"

Evidence: National Academy of Sciences (2017): "Limited evidence that cannabis use is a risk factor for opioid use." Most cannabis users never try other drugs.

Arkansas-specific: Opioid crisis kills 400+ Arkansans annually. Cannabis provides harm reduction alternative. Medical research shows cannabis substitution reduces opioid use.

Arkansas-specific response: "Opioids kill 400 Arkansans every year. Cannabis provides safer alternative for pain management. Let's fight the real drug crisis."

The Bottom Line

Arkansas's cannabis situation is uniquely complex: A functioning medical program in a conservative state with hostile governor, failed 2022 adult-use initiative, but substantial patient base and reasonable public support for reform.

Current medical program: Successfully serves 112,760 patients but faces artificial restrictions (low density, no home grow, delivery barriers) that limit optimization and leave illicit market thriving with 65-75% of total consumption.

Adult-use potential: If legalized with proper policy framework, Arkansas could achieve 75-82% legal market share, generating $80-135M annual tax revenue, creating 4,000-7,000 jobs, and providing substantial economic benefit to rural communities.

The path forward:

Near-term (2025): Optimize medical program

- Expand delivery access

- Add qualifying conditions

- Authorize drive-through dispensaries

- Increase cultivation licenses

Mid-term (2026): Launch improved adult-use initiative

- Conservative-friendly messaging (veterans, agriculture, freedom)

- Enhanced public safety provisions

- Federal reform trigger clause

- Rural economic development focus

- Win 52-55% approval

Long-term (2027-2029): Optimize adult-use market

- Expand to 60-80 dispensaries

- Reduce taxes to 12-15% (once market matures)

- Allow home cultivation (after proving responsible regulation)

- Implement delivery-only licenses for rural access

The prediction: With strategic initiative design, conservative coalition-building, and federal reform alignment, Arkansas could legalize adult-use in 2026, achieving 75-82% legal market share by 2029, generating $80-135M annual tax revenue while maintaining strong public safety standards that respect conservative values.

Arkansas proves that Bible Belt states can embrace cannabis reform—but only through messaging that respects conservative priorities: veterans, agriculture, freedom, safety, and local control.

About This Analysis

This prediction is based on the Consumer-Driven Black Market Displacement (CBDT) Framework, validated across 24 U.S. cannabis markets with 5% mean absolute error and r=0.968 correlation.

Resources:

- Validation data: Harvard Dataverse, DOI: 10.7910/DVN/MDVDTQ

- Framework article: The Black Market Death Equation

- Related analysis:

For Arkansas policymakers, advocates, MSOs, or investors seeking detailed analysis:

Comprehensive state-specific analysis available under commercial license, including:

- Exact market share predictions under multiple policy scenarios

- Initiative campaign strategy and messaging framework

- Conservative coalition-building guidance

- Economic impact modeling (employment, tax revenue, multiplier effects)

- Rural access solutions and delivery network optimization

- Federal reform timeline and state policy alignment

Contact:

- Twitter/X: @The_Silent_420

- Email: silentmajority420@proton.me

The Silent Majority 420 is an anonymous cannabis policy analyst with 25 years of market participation. The CBDT Framework represents the first validated consumer-utility model for predicting market outcomes in vice legalization. Analysis licensed CC BY 4.0 (free use with attribution).